Good news for an emotionally challenging time: there’s hard evidence that simply looking at art you find beautiful can trigger your endorphins, invoking the same feelings of pleasure associated with romantic love, certain drugs and desire.

So here is my humble offering to all the coronavirus whiplashed warriors. It was challenging picking art that everyone will find beautiful. There is no such thing, of course, but I had a soul lifting time trying.

Even if you’re already familiar with these images, try to really look with fresh eyes. See how that feels . I’ve shared one interesting fact about each work to guide your entry into the art.

Gustave Klimpt, The Kiss, 1908

Originally rejected as scandalously erotic, Klimpt’s The Kiss is now deemed by some to be the greatest painting ever created. “If you cannot please everyone with your deeds and your art, please a few” he said. Smart man…

Van Gogh, Starry Night, 1889

Proof that great art sometimes comes from great pain, Van Gogh painted Starry Night at the asylum of Saint Paul de Mausole, France, while suffering from epileptic fits and declining mental health. How do you think that affected his palette choice?

Henry Rousseau, The Dream, 1910

The Dream, huge at almost 7 by 10 feet, was Rousseau’s last painting, and the masterpiece of his 25 jungle themed works. How many animals can you find? I’m at 8 and counting…

Andrew Wyeth, Christina’s World, 1948

Looking out the window of his Maine summer residence, Wyeth saw Christina Olson, a neighbor who suffered from a neuromuscular disease, crawling across a field picking blueberries. “The challenge to me was to do justice to her extraordinary conquest of a life which most people would consider hopeless.”

Morris Louis, Dalet Kaf, 1959

Using a soak stain technique he learned from Helen Frankenthaler – see below – Louis went ginormous, as here at over 8 x 10 feet, and created visual cathedrals of feeling.

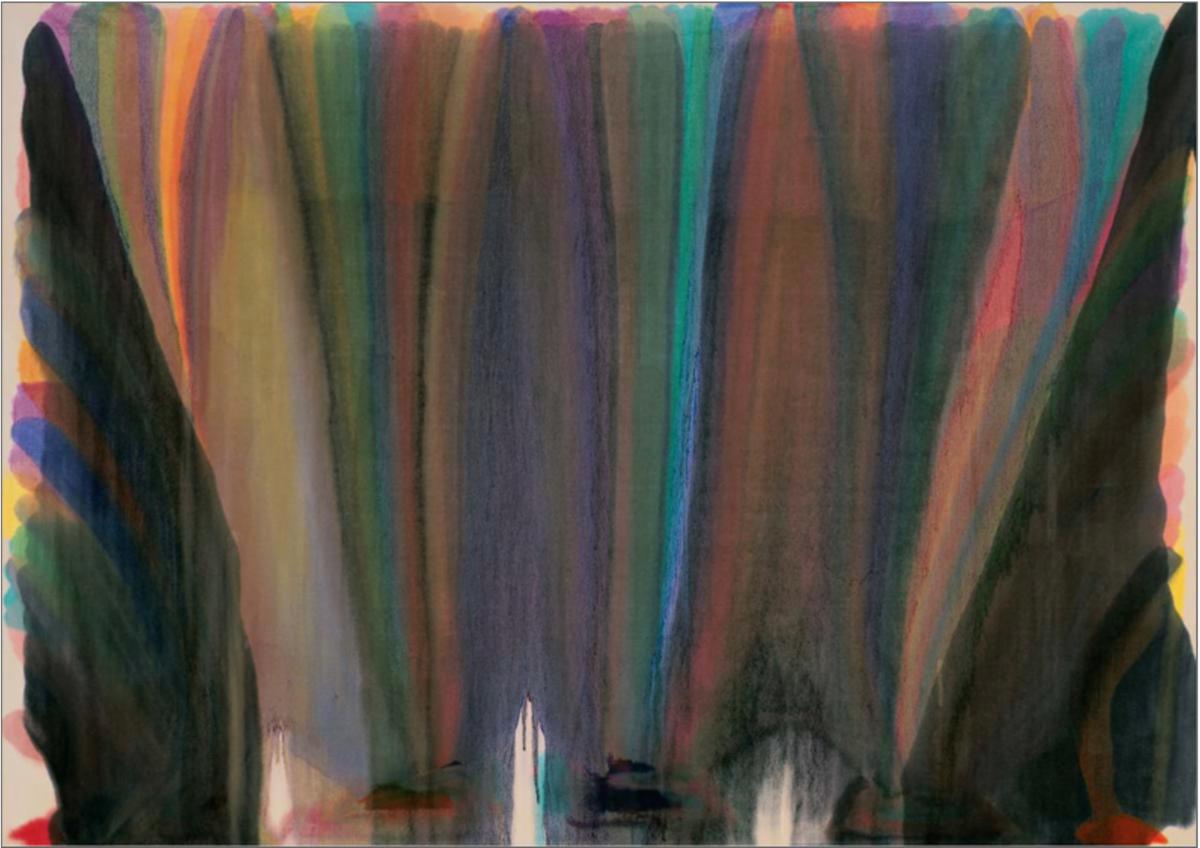

Helen Frankenthaler, Flirt, 1995

Nobody does more gorgeous color. If I could choose my next life, it would be to paint like this. I saved the best for last.

- Introducing Free Fridays:

- Send your art questions, including photos, to jacqui@beckerfinearts.com. Every Friday I will answer the most interesting question on Instagram @jacquibecker.