The Bad:

Predictably, COVID induced the biggest recession in the global art market since the financial crisis of 2009.

Total sales of artwork across all platforms—on line, auction and gallery venues—was down 20–30%. None the less, most dealers managed to offset lost sales with reduced expenses from canceled art fairs or exhibitions. Gallery and auction staff lost their jobs, but the most powerful global art dealers actually had their best year ever, a disparity similar to the global fallout from the pandemic that disproportionately devastated those with less power.

While the nascent world of on line art sales remained roughly unchanged from 2016-19, in 2020 on line’s speed, convenience and competitive pricing was bolstered by lock downs to post an increase. This was especially true for on line auction house sales, where Christies, Sotheby’s and Phillips posted record breaking on line sales increases of almost 400% from 2019. But while deep pocketed auction houses managed to control losses, many small galleries closed.

Winners and Losers: In July 2020, Pop art mainstay Wayne Thiebaud’s “Four Pinball Machines” was sold via on line auction by Christies Auction House for $19.1 million, double the artist’s previous record.

The Good:

All those on line sales came with an industry wake up call benefitting art collectors who have been turned off for years by the coy price hiding strategies of traditional galleries and art fairs. The biggest impediment sited by art collectors to making a purchase has been lack of easy access to pricing information. On line sales that generally post prices remade that playing field. The average price of a work of art purchased on line in 2020 was $5000, considered entry level cost, but an increased percentage of these buyers were millennials, who just might be the future market movers.

Across the United States and the world, museums have begun to address the reckoning with racism and inequity the pandemic laid bare.

Just a few examples of how:

- “Promise, Witness, Remembrance” reflecting on the life and death of Breonna Taylor, at the Louisville Kentucky Speed Museum: http://bit.ly/rememberingBreonna

- While museums sat empty and exhausted working parents homeschooled children, The Museum Computer Network (MCN) stepped up to create an exhaustive list of 100’s of virtual museum resources http://bit.ly/virtualmuseumresources which equalize access to culture and enrich students lives.

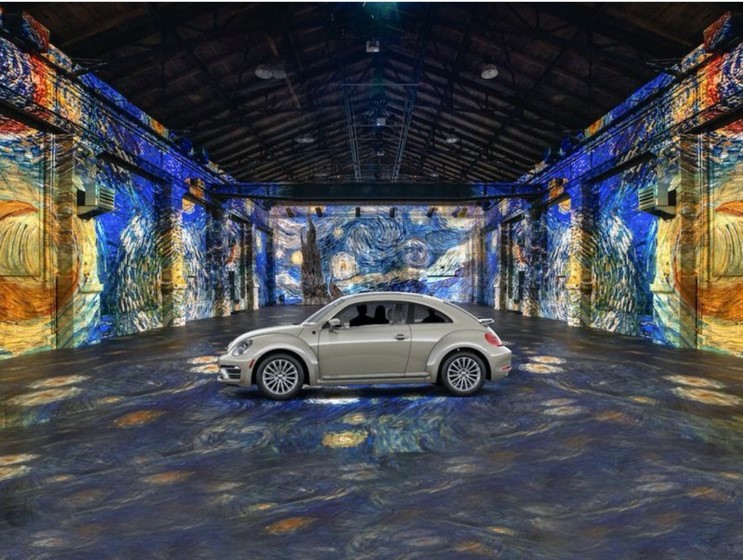

- The very design of museums is being rethought to address issues of accessibility and hygiene once we return in person, including cues from banks and movie theatres prompting the creation of the immersive drive thru museum: http://bit.ly/museumredesign

“Gogh by Car”, a drive through Van Gogh exhibit in Toronto last July, designed by artist Massimiliano Siccardi with soundtrack by Luca Longobardi, provided a completely immersive experience of Starry Night and Sunflower from the safety and comfort of your car.

The Really Weird: A multiple choice question situation.

NFT’s are:

- Non-Fungible Tokens

- A form of crypto currency

- A new way of buying, selling and investing in art or other digital assets where the currency, not the art, is unique and unforgeable.

- A marketing stunt proving there are too many people with too much money who are running out of attractive investments.

- All of the above…*

If you haven’t heard about NFTs yet, you will soon. NFTs, or non-fungible tokens, are unique assets minted on and authenticated by blockchain. They can be used to establish ownership of anything digital. In March Jack Dorsey sold the NFT of his first tweet for $2.9 million. Christies Auction House just made headlines by selling the NFT of a digital work of art by Beeple (I hadn’t heard of him either) for $69 million.

I think it’s safe to say there’s a gold rush going on here as art collectors seek to get in on the ground floor of what might be the future of the very concept of ownership and art investment. At the very least, NFTs are a diabolically disruptive force in the art market. Blue chip artists like Damien Hirst are jumping in, shamelessly but aptly entitling the body of prints behind his NFT’s

“The Currency”, an accurate moniker given the $22.4 million he racked up.

If NFTs embody a new form of commerce, there are some aspects which feel decidedly familiar. It is techno savvy financiers, not art dealers, who have created this marketplace for investing. And much like old school art investors who would relegate their latest purchases to a vault for safekeeping, the “art” for which the NFT authenticates ownership often never sees the light of day. One could ask if it ever really existed at all.

* Yup, you guessed it.

“Everydays: The First 5000 Days NFT, by Beeple (AKA Mike Winkelmann), the first purely digital artwork sold at Christies in March 2021 for $69 million